IONIC ERP Tutorial

Lone Modules

- Loan Management

- Loan Type (HR)

- Loan Application (HR)

- Loan (HR)

- Loan Security Type

- Loan Security

- Loan Security Price

- Loan Type (LM)

- Loan Application (LM)

- Loan Application (LM)

- Loan Security Pledge

- Loan

- Loan Disbursement

- Loan Interest Accrual

- Loan Repayment

- Loan Write Off

- Loan Security Shortfall

- Loan Security Unpledge

- Process Loan Interest Accrual

- Process Loan Security Shortfall

Loan Management

Loan Management module in IONIC ERP helps you manage your loans right from Loan Application to Loan Closure. You can track disbursements, repayments, security pledging and unpledging, loan interest accrual and much more.

Here is the flow of the loan management cycle :

Loan Type

Loans can be categorized into different types based on their specific characteristics.

In Frappe HR, you can define different Loan Types, their Rate of Interest and other related information in the Loan Type doctype.

To access Loan Type go to:

> Human Resources > Loans > Loan Type

1. How to create a Loan Type

- Go to: Loan Type.

- Enter the Loan Name.

- Enter the Rate of Interest (%) Yearly.

- Optionally, you can also enter the Maximum Loan Amount and Description of the Loan Type.

- Save.

Loan Application

Loan Application is a document which contains the information regarding the Loan Applicant, Loan Type, Repayment Method, Loan Amount and Rate of Interest.

Employee can apply for loan by going to:

> Human Resources > Loan > Loan Application

1. Prerequisites

Before creating a Loan Application, it is advisable to create the following documents:

- Employee

- Loan Type

2. How to create a Loan Application

- Go to: Loan Application > New.

- Enter the Applicant name.

- Enter loan information such as a Loan Type, Loan Amount and Required by Date.

- Select the Repayment Method and based on loan information, information such as Total Payable Amount and Interest will be calculated.

- Save and Submit.

3. Features

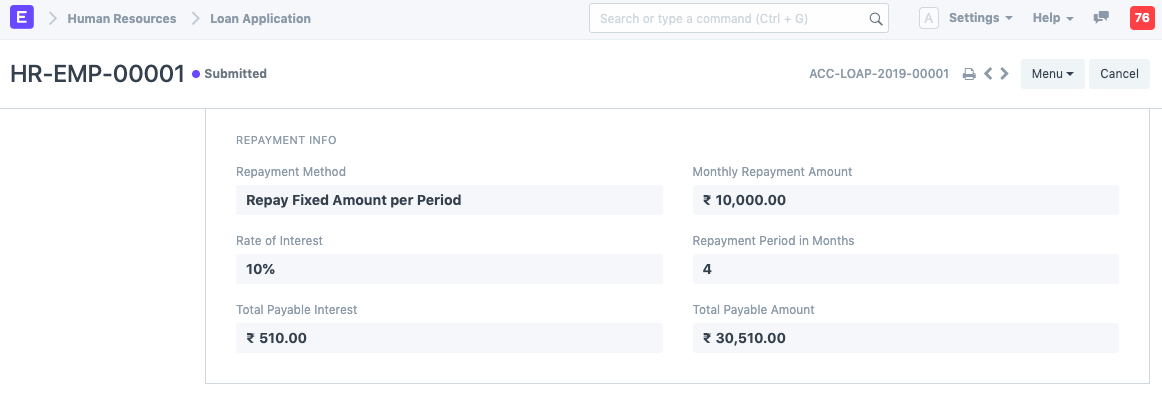

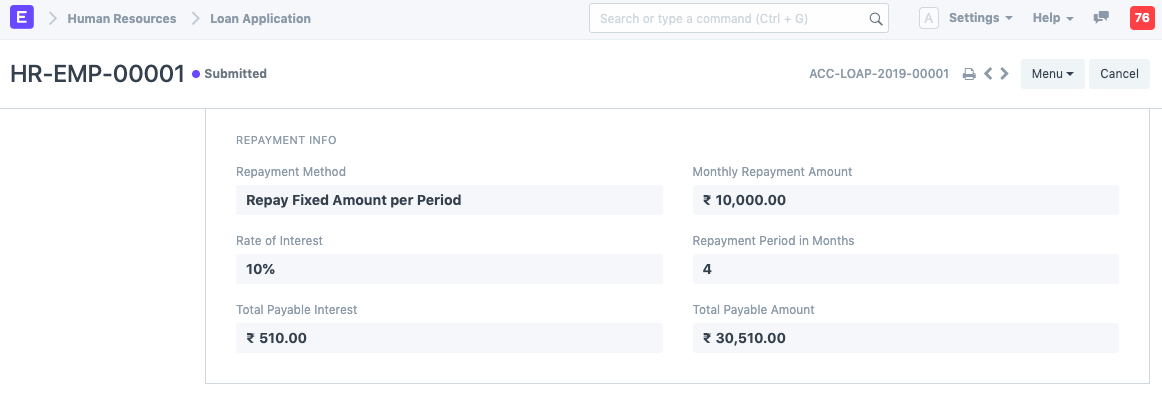

3.1 Repayment Method

There are two types of Repayment Methods in Loan Application:

1. Repay Fixed Amount Per Period

- Enter the Monthly Payment Amount.

- Save.

- Once saved, based on the Rate of Interest, the Total Payable Interest and Total Payable Amount will be calculated along with Period in Months.

- Submit.

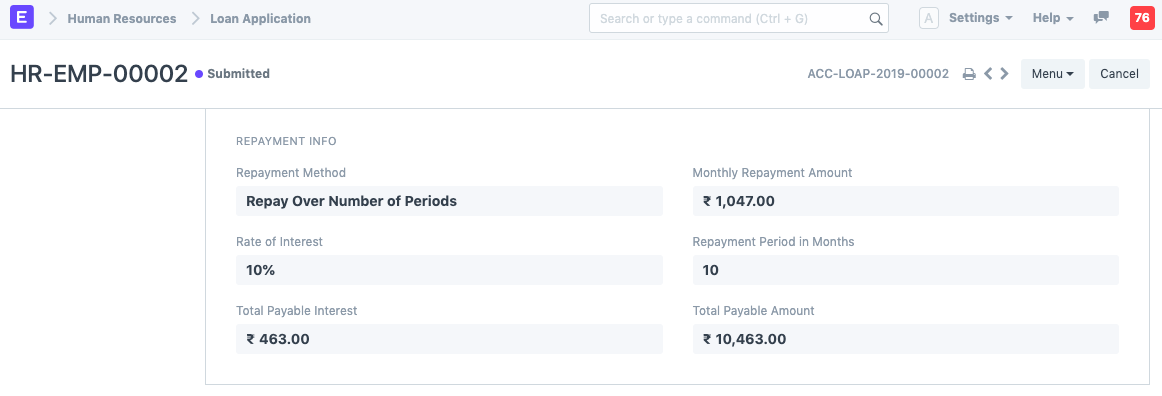

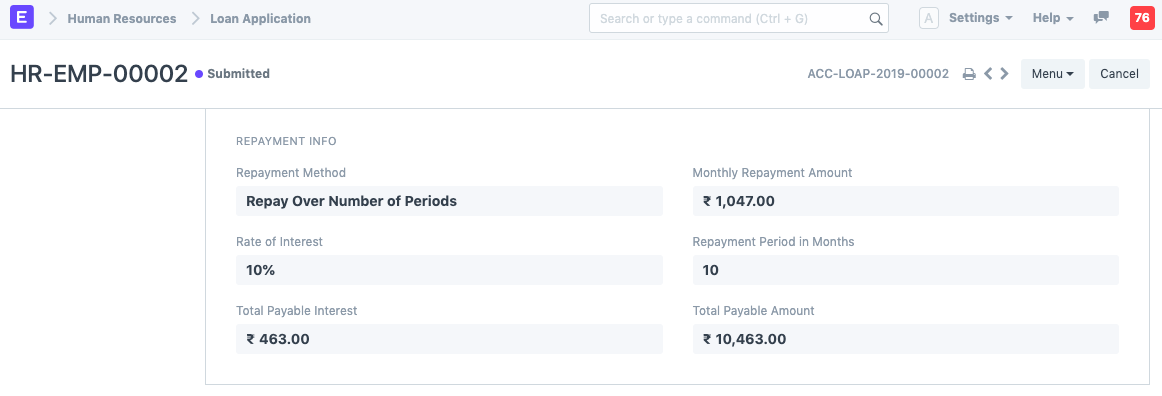

2. Repay Over Number Of Periods

- Enter the Repayment Period in Months.

- Save.

- Once saved, based on the Rate of Interest, the Total Payable Interest and Total Payable Amount will be calculated along with Monthly Repayment Amount.

- Submit.

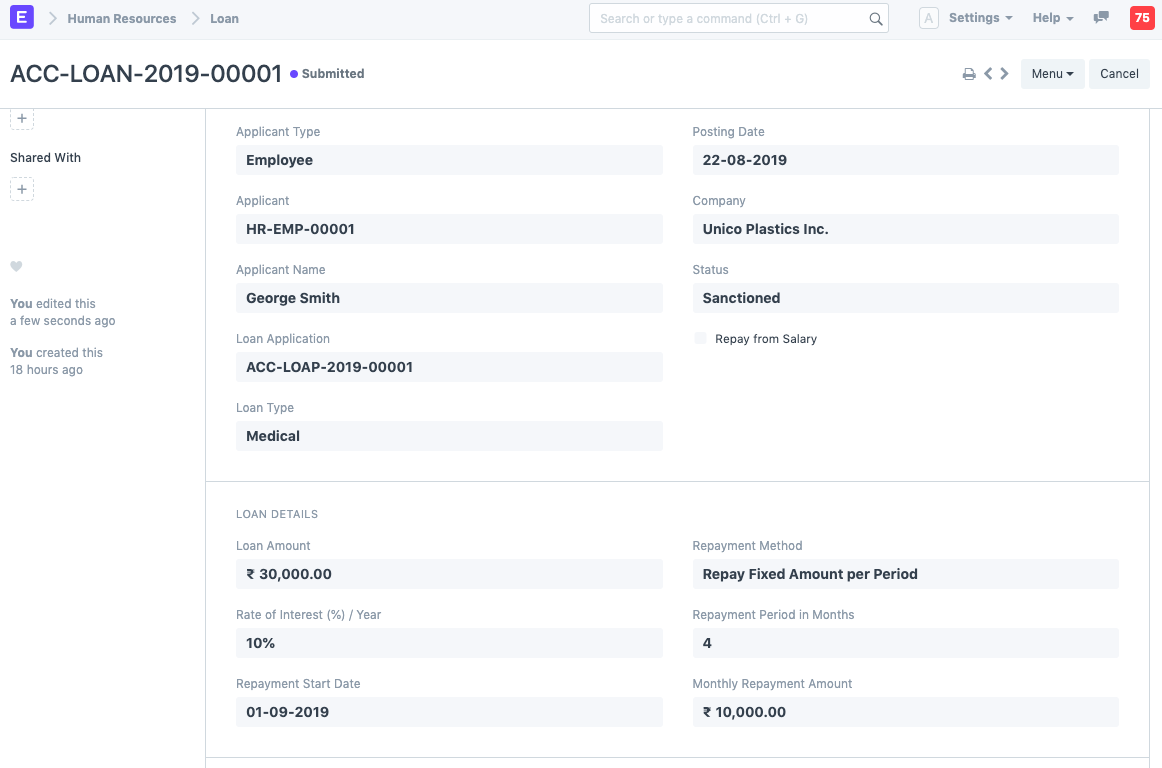

Loan

Once the Loan Application is approved by the manager, a Loan record and repayment schedule can be created for the Applicant using the Loan.

To access Loan, go to:

> Human Resources > Loans > Loan

1. Prerequisites

Before creating a Loan record, it is necessary that you create the following documents:

- Loan Type

- Loan Application

- Chart of Accounts

2. How to create a Loan record

- Go to: Loan > New.

- Select the Applicant name.

- Select the Loan Application. Once selected, loan information such as Loan Type, Loan Amount, Rate of Interest, Repayment Method, Repayment Period in Months and Monthly Repayment Amount will be fetched.

- Enter Repayment Start Date.

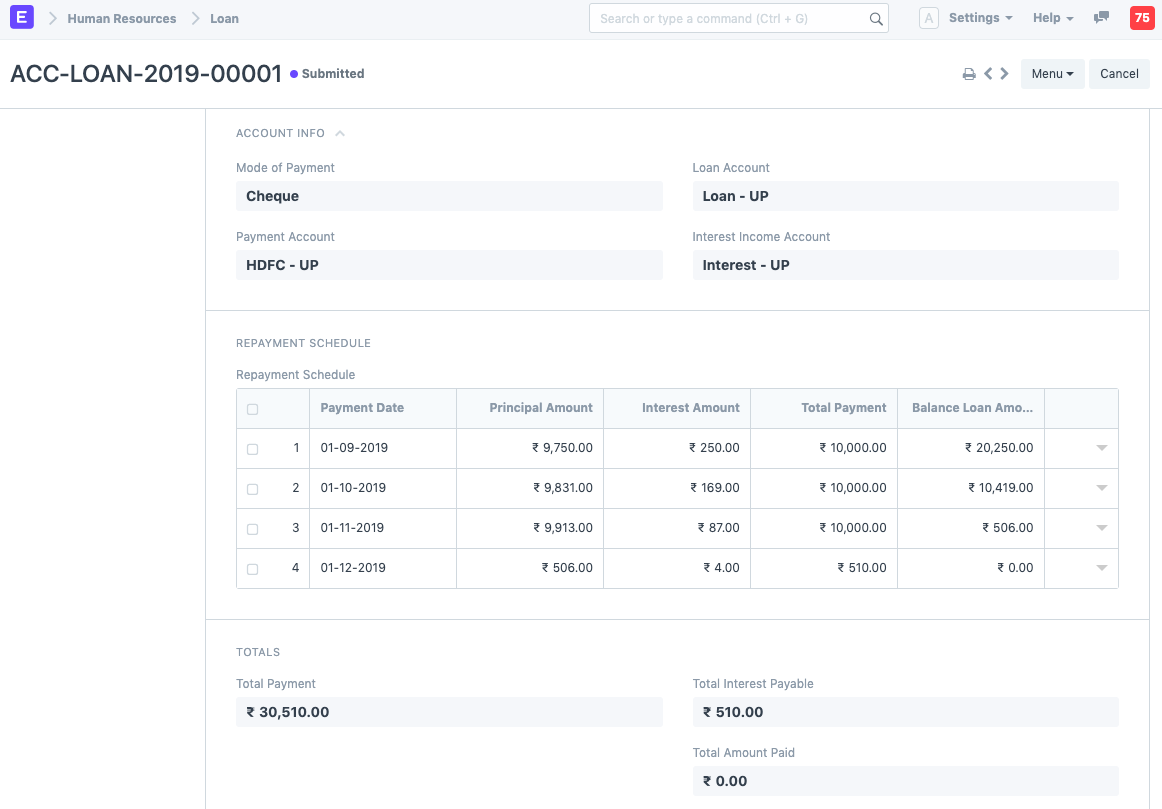

- Enter Account Information such as Mode of Payment, Payment Account, Loan Account and Interest Income Account.

- Save. Once saved, a Repayment Schedule is automatically generated. The first repayment payment date would be set as per the “Repayment Start Date”. The

> Note: Check “Repay from Salary” if the loan repayment will be deducted from the salary

You can alternatively create a Loan record directly from Loan Application

3. Features

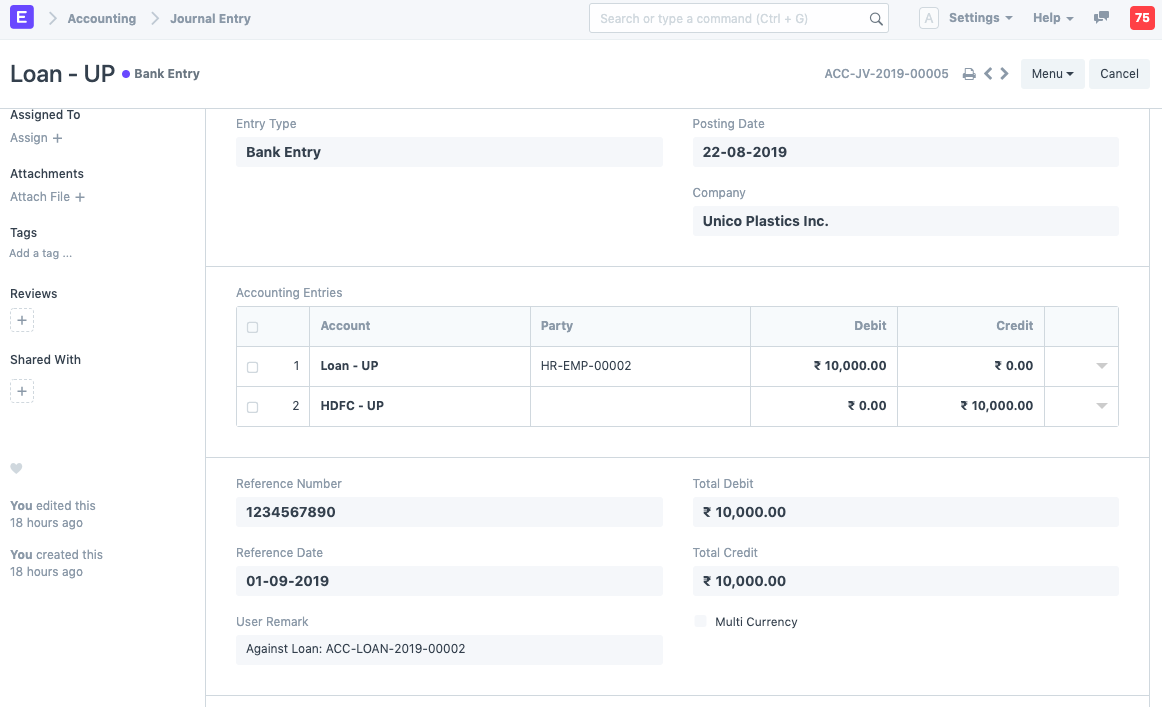

3.1 Creation of Disbursement Entry

After submitting the Loan document, if the status is “Sanctioned”, you can click on “Create Disbursement Entry” to create a Journal Entry of the Loan.

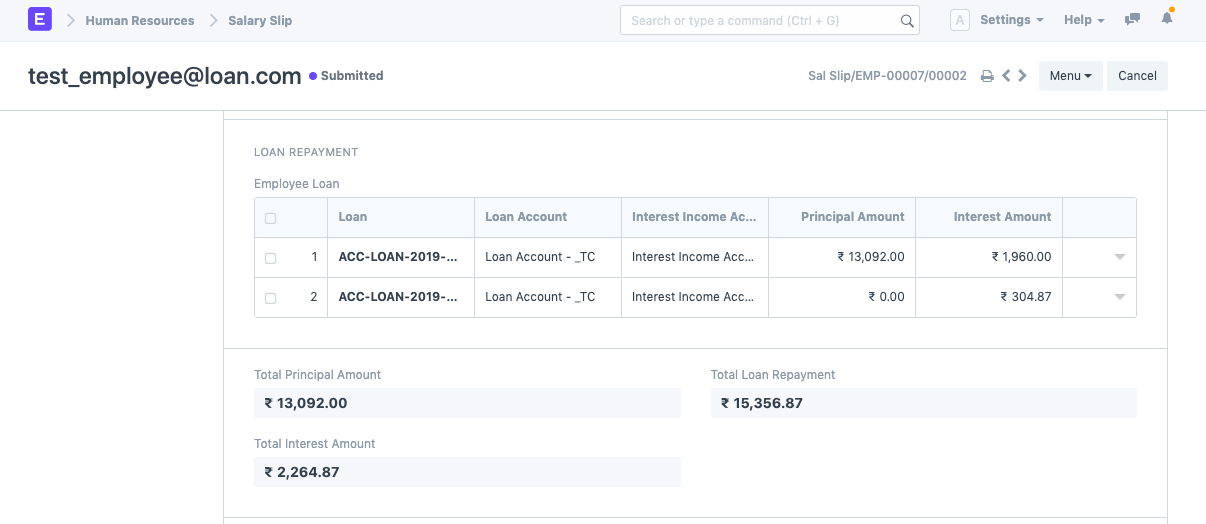

3.2 Loan repayment deduction from Salary

To auto deduct the Loan repayment from Salary, check “Repay from Salary” in Loan. It will appear as Loan Repayment in Salary Slip.

3.3 Extending the Loan

Loan amount is deducted from the salary. If the employee is on leave without pay for some period, the existing loan can be extended without the need for creating a new loan. This can be done be editing the Repayment Schedule table even after submitting the loan.

Loan Security Type

> Introduced in Version 13

Loan Security Type defines the type of security that can be pledged against a loan like Stocks, land, etc.

During a loan process, if the loan for which the applicant is applying is a secured loan then some kind of security needs to be pledged against that loan. In Loan Security Type master you can define that type of security.

To access the Loan Security Type list, go to: > Home > Loan Management > Loan Security > Loan Security Type

A Loan Security Type contains details about:

- Unit Of Measurement: The UOM of the loan security

- Haircut %: The haircut on that loan security

- Loan to Value Ratio: The Loan To Security Value Ratio, below which loan security shortfall should be created

> Haircut percentage is the percentage difference between market value of the Loan Security and the value ascribed to that asset when used as collateral for that loan.

Loan Security

> Introduced in Version 13

A Loan Security is the actual security that is going to be pledged against a loan.

During a loan process, if the loan for which the customer is applying is a secured loan then some kind of security needs to be pledged against that loan. Loan Security specifies the actual security that is going to be pledged against a Loan.

To access the Loan Security list, go to: > Home > Loan Management > Loan Security > Loan Security

1. Prerequisites

Before creating and using a Loan Security, it is advised that you create the following first:

- Loan Security Type

2. How to Create a Loan Security

- Go to the Loan Security list, click on New.

- Select the Loan Security Type.

- Enter Haircut %.

- Enter Loan Security Code.

- Enter current Loan Security Price.

- Enter Unit of Measurement

- Click on Save.

Loan Security Price

> Introduced in Version 13

Loan Security Price is the record in which you can log the loan security price and its validity.

During a loan security price update process, Loan Security Price is used to fetch the valid loan security price for updation.

To access the Loan Security Price list, go to: > Home > Loan Management > Loan Security > Loan Security Price

1. Prerequisites

Before creating and using a Loan Security Price, it is advised that you create the following first:

- Loan Security Type

- Loan Security

2. How to Create a Loan Security Price

- Go to the Loan Security Price list, click on New.

- Select the Loan Security. The Loan Security Type and UOM will be automatically fetched from the Loan Security Type master.

- Enter Loan Security Price.

- Enter the Valid From and Valid Up to timestamps.

- Click on Save.

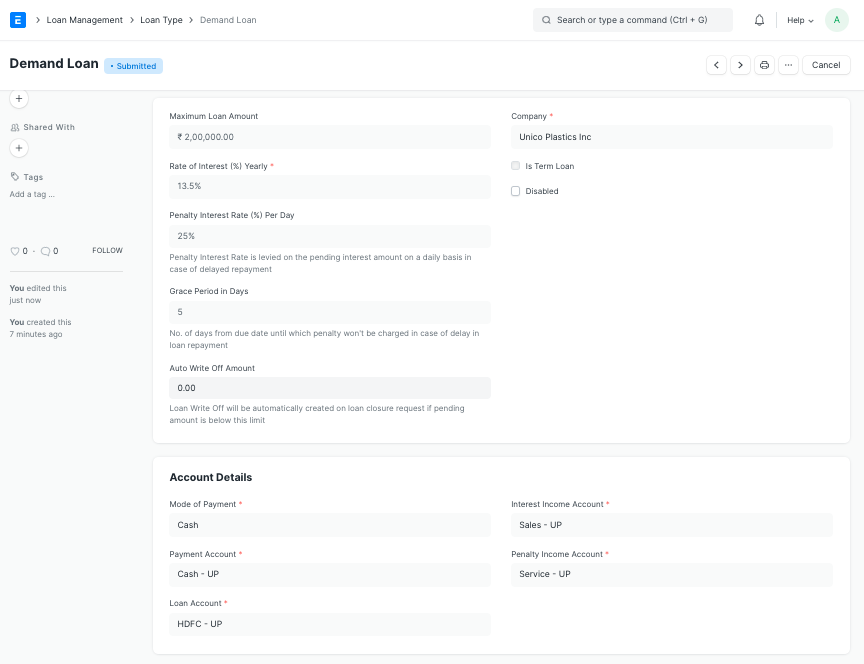

Loan Type

> Introduced in Version 13

A Loan Type is where you can define various loan types and their properties like rate of interest, loan account details, etc.

To access the Loan Type list, go to: > Home > Loan Management > Loan > Loan Type

1. How to Create a Loan Type

- Enter Loan Name.

- Enter Company.

- Enter yearly rate of interest to be charged on the principal amount.

- Enter Mode Of Payment and account details.

- Click “Save” to save the draft of the loan type.

- Click “Submit” to submit the loan type

2. Feature

2.1 Creating Term Loans and Demand Loans

Is Term Loan: Is Term Loan specifies whether a Loan is a Term Loan or a Demand Loan. If this is unchecked any loan of this type will be considered as a demand loan and an automatic repayment schedule won’t be generated for that loan.

> Demand Loans are open ended loans which do no have a fixed repayment schedule or a fixed repayment amount.

Loan Application

Loan Application is a document which contains the information regarding the Loan Applicant, Loan Type, Repayment Method, Loan Amount and Rate of Interest.

Employee can apply for loan by going to:

> Human Resources > Loan > Loan Application

1. Prerequisites

Before creating a Loan Application, it is advisable to create the following documents:

- Employee

- Loan Type

2. How to create a Loan Application

- Go to: Loan Application > New.

- Enter the Applicant name.

- Enter loan information such as a Loan Type, Loan Amount and Required by Date.

- Select the Repayment Method and based on loan information, information such as Total Payable Amount and Interest will be calculated.

- Save and Submit.

3. Features

3.1 Repayment Method

There are two types of Repayment Methods in Loan Application:

1. Repay Fixed Amount Per Period

- Enter the Monthly Payment Amount.

- Save.

- Once saved, based on the Rate of Interest, the Total Payable Interest and Total Payable Amount will be calculated along with Period in Months.

- Submit.

2. Repay Over Number Of Periods

- Enter the Repayment Period in Months.

- Save.

- Once saved, based on the Rate of Interest, the Total Payable Interest and Total Payable Amount will be calculated along with Monthly Repayment Amount.

- Submit.

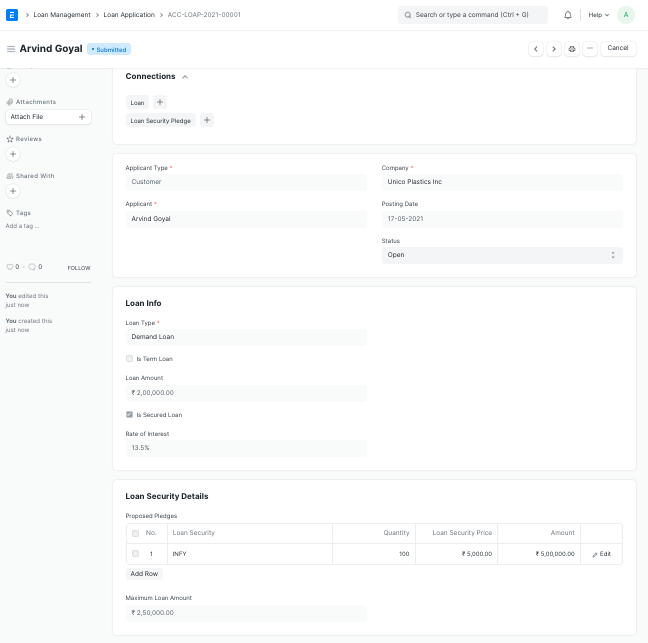

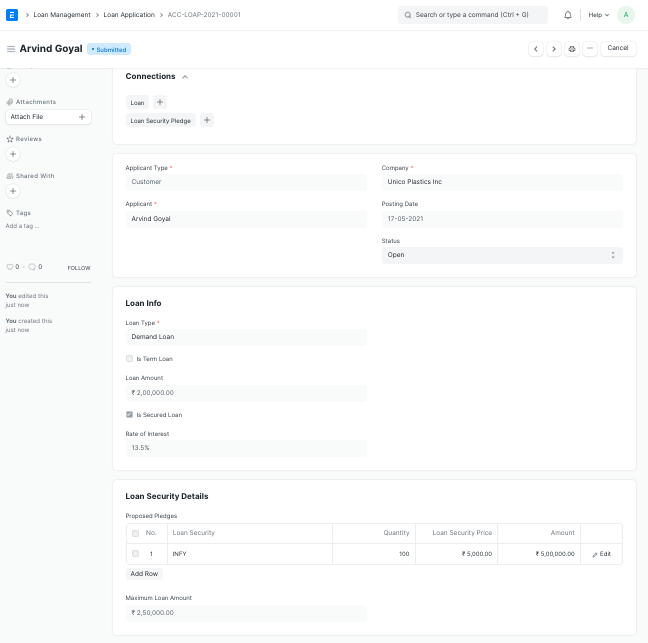

Loan Application

> Introduced in Version 13

A Loan Application contains details about the applicant and loan security details for review.

During a loan process, the first step a customer or employee has to do is submit a Loan Application for review. In case of a secured loan, a Loan Application can also contain proposed loan securities.

To access the Loan Application list, go to: > Home > Loan Management > Loan > Loan Application

1. Prerequisites

Before creating and using a Loan Security, it is advised that you create the following first:

- Loan Security Type

- Loan Security

- Loan Type

2. How to Create a Loan Application

- Go to Loan Application List, click on New.

- Select the Applicant Type.

- Select the Applicant.

- Select the Loan Type. All the loan details like rate of interest, loan accounts will be automatically fetched from the Loan Type.

- Enter the Loan Amount.

- If the loan is a term loan, enter the Repayment Method. If the Repayment Method is selected as “Repay Over Number Of Periods” then you will have to enter the number of months in which the repayment will be made in “Repayment Period in Months”. If the repayment method is selected as “Repay Fixed Amount per Period ” then you will have to enter the “Monthly Repayment Amount”.

- You can also mention the proposed securities that will be pledged against a loan. For that, first tick the “Is Secure Loan” checkbox. Then in the proposed pledges table, you can enter the securities and their quantities.

- Click “Save” to save the draft of the Loan Application.

- Click “Submit” to submit the loan application.

3. Features

3.1 Creating the Loan Security Pledge

A Loan Security Pledge based on the proposed securities can be created from the Loan Application itself via Create button on the top right. This Loan Security Pledge can then be pledged against a loan as an initial Loan Security Pledge.

3.2 Submitting the Loan Application

Once a Loan Application is submitted and approved, you can create a Loan from the Loan Application using the Create button and all the required details from the Loan Application will be automatically mapped in the loan.

Loan Security Pledge

> Introduced in Version 13

Loan Security Pledge contains the loan security and the quantity pledged against a Loan.

To access the Loan Security Pledge list, go to: > Home > Loan Management > Loan > Loan Security Pledge

1. Prerequisites

Before creating and using a Loan Security, it is advised that you create the following first:

- Loan Security Type

- Loan Security

- Loan Application

2. How to Create a Loan Security Pledge

- Go to Loan Security Pledge List, click on New.

- Select Applicant Type.

- Select the Applicant.

- Select Company.

- Enter the Loan Securities and their quantities to be delivered in the Securities table. The Loan Security Price will be fetched from the Item master Valuation Rate and the amount will be auto calculated.

- Click “Save” to save the draft of the Loan Security Pledge.

- Click “Submit” to submit the Loan Security Pledge.

- Once the Loan Security Pledge is Submitted it is ready to be Pledged Against a Loan.

2.1. Other ways to create a Loan Security Pledge

- You can also create a Loan Security Pledge from an approved Loan Application via the Create button on the top right

- Or you can also create a Loan Security Pledge from the Loan Security Shortfall in case of a loan security to value shortfall by clicking on the Add Loan Security button on the top right

Loan

> Introduced in Version 13

Loan record is the loan account which contains all the information regarding a loan.

Loan record acts as a loan account which contains all the applicant details, repayment schedule, and repayment info. All the loan related documents like Loan Disbursement, Loan Repayment, etc are linked to a Loan.

To access the Loan List list, go to: > Home > Loan Management > Loan > Loan

1. Prerequisites

Before creating and using a Loan, it is advised that you create the following first:

- Loan Security Type

- Loan Security

- Loan Type

- Loan Application

- Loan Security Pledge

2. How to Create a Loan

- Go to Loan List, click on New.

- Select Applicant Type.

- Select the Applicant.

- Select Loan Application if Loan Application is created against that Applicant. All the details in loan application will be automatically fetched in the Loan record.

- Select Company.

- Enter posting date.

- If applicant type is Employee then check “Repay from Salary” if loan will be repaid from salary.

- Enter Loan Type. All the loan accounts, mode of payment and other loan details like whether the loan is a term loan or demand loan will be automatically fetched from the loan type master. If loan is a term loan repayment schedule will be auto generated on saving the loan document.

- Check ‘Is Secured Loan’ if the loan is a secured loan. Also select ‘Loan Security Pledge’ if the loan is a secured loan.

- Click “Save” to save the draft of the Loan.

- Click “Submit” to submit the Loan Security Pledge.

- Once the Loan is submitted the loan amount is ready to be disbursed.

2.1. Other ways to create a Loan

You can also create a Loan from an approved Loan Application via the Create button on the top right.

3. Features

3.1 Creation Of Disbursement Entry

After submitting the Loan document, if the status is “Sanctioned” and “Repay from Salary” is unchecked, you can create Loan Disbursement from the loan document via Create button on top right.

3.2 Creation Of Repayment Entry

If the loan is fully or partially disbursed and “Repay from Salary” is unchecked, you can create a Loan Repayment from the loan document via Create button on top right.

3.3 Loan Repayment Deduction from salary

To auto deduct the Loan repayment from Salary, check “Repay from Salary” in Loan. It will appear as Loan Repayment in Salary Slip and a Loan Repayment record will also be automatically created for the it.

Loan Disbursement

> Introduced in Version 13

Once a Loan is sanctioned, the loan amount is ready to be disbursed. For that, a Loan Disbursement entry is created.

To access the Loan Disbursement list, go to: > Home > Loan Management > Disbursement and Repayment > Loan Disbursement

1. Prerequisites

Before creating a Loan Disbursement, you must create the following first:

- Loan

2. How to Create a Loan Disbursement

- Go to Loan Disbursement List, click on New.

- Select Loan against which the loan amount is to be disbursed. The Applicant Type and Applicant will be fetched from the Loan.

- Enter Disbursement Date.

- Enter Disbursed Amount.

- Click “Save” to save the draft of the Loan Disbursement.

- Click “Submit” to submit the Loan Security Pledge.

2.1. Other ways to create a Loan Disbursement

You can also create a Loan Disbursement from a sanctioned Loan via the Create button on the top right

3. Features

3.1 Multiple Disbursements against a Loan

Multiple Loan Disbursements can be made against a Loan unless you don’t cross the sanctioned amount loan amount against a Loan.

3.2 Loan Topup

Loan Disbursement can also be made once some of the loan amount is repaid and adequate amount of security is still pledged against that loan. This is known as a loan topup.

Loan Interest Accrual

> Introduced in Version 13

Loan Interest will be accrued monthly on first day of every month for demand loans and one day before payment day for term loans.

To access the Loan Interest Accrual list, go to: > Home > Loan Management > Disbursement and Repayment > Loan Interest Accrual

A Loan interest accrual contains the details about:

- Loan: The Loan against which the interest has been accrued

- Applicant: The applicant type and the applicant name

- Pending Principal Amount: Pending Principal amount against the loan

- Interest Amount: Interest Amount accrued against the loan

- Is Paid: Is paid checkbox indicates whether the accrued loan interest has been paid or not

- Process Loan Interest Accrual is the process by which Loan Interest was accrued

Loan Repayment

> Introduced in Version 13

Loan Repayment entry is used to track repayments against loans.

To access the Loan Disbursement list, go to: > Home > Loan Management > Disbursement and Repayment > Loan Repayment

1. Prerequisites

Before creating a Loan Disbursement, you must create the following first:

- Loan

- Loan Interest Accrual

2. How to Create a Loan Repayment

- Go to Loan Repayment List, click on New.

- Select Loan against which repayment is being made. The Applicant Type and Applicant will be fetched from the Loan.

- Select Payment Type. The default option is ‘Regular Repayment’ which is selected in case of normal monthly payment and ‘Loan Closure’ in case of final repayment or the Loan needs to be closed.

- Enter Posting Date. On entering the Posting Date, all the payable amounts like pending principal amount, interest payable, penalty amount, and payable amount will be automatically fetched.

- Click “Save” to save the draft of the Loan Repayment Entry

- Click “Submit” to submit the Loan Repayment Entry.

2.1. Other ways to create a Loan Repayment

You can also create a Loan Repayment from a disbursed Loan via the Create button on the top right of a Loan.

Loan Write Off

> Introduced in Version 13

Loan Write Off is used to write off the pending principal amount against a loan in order to close the loan.

To access the Loan Write Off list, go to: > Home > Loan Management > Disbursement and Repayment > Loan Write Off

1. Prerequisites

Before creating a Loan Write Off, you must create the following first:

- Loan

2. How to create a Loan Write Off

- Go to the Loan Write Off list, click on New.

- Select the Loan for which the principal amount has to be written off. The Applicant Type and Applicant will be fetched from the Loan.

- Enter Posting Date.

- Select the Write Off Account.

- Enter the write off amount.

- Click “Save” to save the transaction

- Click “Submit” to submit the Loan Write Off entry.

3. Features

3.1 Write off principal amount against a loan

Loan Write Off allows you to write off any bad debts against a loan and request loan closure.

Loan Security Shortfall

> Introduced in Version 13

If loan to security value ratio falls below a specific value, a Loan Security Shortfall is automatically created for that specific loan.

To access the Loan Security Shortfall list, go to: > Home > Loan Management > Loan Security > Loan Security Shortfall

A Loan Security Shortfall contains the details about:

- Loan: The Loan against which there is a Loan to security value shortfall.

- Shortfall Time: The time at which the shortfall record was created.

- Status: The status of the shortfall. Pending is the default status and it changes to Complete once a payment is made or additional security is pledged against the loan to satisfy the shortfall.

- Loan Amount: Loan amount is the pending loan amount which is used for shortfall calculation.

- Security Value: Security Value is the current pledged security value.

- Shortfall Amount: Shortfall amount is the difference between the loan amount and the security value which needs to be repaid to complete the shortfall.

1. Features

Additional Loan Security can be pledged against a loan from the Loan Security Shortfall itself via the Add Loan Security button on the top right.

Loan Security Unpledge

> Introduced in Version 13

Once all the loan amount is paid, a Loan Security Unpledge is created for unpledging the securities.

To access the Loan Security Unpledge list, go to: > Home > Loan Management > Loan Security > Loan Security Unpledge

1. Prerequisites

Before creating a Loan Security Unpledge, you must create the following first:

- Loan Security Type

- Loan Security

- Loan

2. How to Create a Loan Security Unpledge

- Go to Loan Security Unpledge List, click on New.

- Select Loan against which the securities are unpledged.

- Select Applicant.

- Select Company

- In the securities table enter the Loan Security and their quantity to be unpledged. Also enter the Loan Security Pledge for which the securities needs to be unpledged.

- Click “Save” to save the draft of the Loan Security Unpledge.

- Click “Submit” to unpledge the loan securities

2.1. Other ways to create a Loan Security Unpledge

You can also create a Loan Security Unpledge from a Loan on which loan closure is requested via the Create button on the top right

3. Features

3.1 Approval of Loan Security Unpledge Request

On approval of the Loan Security Unpledge it will automatically update the qty and status in the corresponding Loan Security Pledge. In case of full unpledge the status in Loan Security Pledge against which the unpledge request is made will set as “Unpledge” otherwise it will be set as “Partially Pledged”. In case of full unpledge, the Loan against which unledge request is made will also be automatically closed.

Process Loan Interest Accrual

> Introduced in Version 13

Process Loan Interest record is created on every loan Interest accrual cycle and is also used for manually processing loan interest accrual.

To access the Process Loan Interest Accrual list, go to: > Home > Loan Management > Loan Processes > Process Loan Interest Accrual

Loan Interest will be accrued monthly on the first day of every month for demand loans and one day before payment day for term loans by a background job. If you want to accrue interest manually against a loan then it can be done using Process Loan Interest Accrual.

1. Prerequisites

Before creating a Process Loan Interest Accrual, you must create the following first:

- Loan

2. How to create Process Loan Security Shortfall

- Go to Process Loan Interest Accrual List, click on New.

- Enter Posting Date. Posting Date is the date till which the interest will be accrued from the last interest accrual date.

- Enter Loan Type if you want to accrue interest for a specific Loan Type. If no Loan Type is entered then interest will be accrued for all the Loan Types.

- Enter Loan if you want to accrue interest for a specific loan. If no loan is entered then loan will be accrued for all the loans.

- Click “Save” to save the draft of the Loan Disbursement.

- Click “Submit” to submit the Loan Security Pledge.

Process Loan Security Shortfall

> Introduced in Version 13

Process Loan Security Shortfall record is created on loan security price update and is also used for manual processing of Loan Security Price.

To access the Process Loan Security Shortfall list, go to: > Home > Loan Management > Loan Processes > Process Loan Security Shortfall

1. Prerequisites

Before creating a Loan Security Unpledge, you must create the following first:

- Loan Security Type

- Loan Security

- Loan Security Price

2. How to create Process Loan Security Shortfall

- Go to Process Loan Security Shortfall List, click on New.

- Enter From Time and To Time. All the Loan Security Price between the From Time and To Time will be considered for updating the Loan Security Master.

- Enter Loan Security Type if only the prices of a specific Loan Security Type needs to be updated.

- Click “Save” to save the draft of the Loan Disbursement.

- Click “Submit” to submit the Loan Security Pledge.